In an increasingly volatile landscape, mergers and acquisitions (M&A) have become far more than financial transactions—they are complex operational undertakings shaped by geopolitics, technology, and organizational transformation. The rising threat of a global trade war is forcing companies to rethink how, where, and when they pursue deals. With the potential for tariffs, sanctions, and retaliatory policies disrupting global supply chains and market access, M&A strategies must now factor in political risk as a core consideration. As organizations seek to unlock value through integration, they must also navigate shifting regulatory landscapes, redesign shared services delivery models, and realign corporate real estate (CRE) to support distributed and resilient operations. This article explores how these forces are reshaping M&A integration strategies in 2025—and why agility, location intelligence, and cross-functional planning are more critical than ever.

Geopolitical Risk: The New M&A Frontier

Geopolitical volatility is now a first-order concern for M&A strategy. From sanctions and trade restrictions to political instability and regulatory overreach, cross-border deals are fraught with complexity.

Key Impacts on M&A and Shared Services:

- Regulatory Delays: Increased scrutiny, especially in tech, infrastructure, and energy.

- Friendshoring Trends: Shifting shared services to politically stable and allied regions.

- Data Sovereignty Pressures: Compliance with evolving laws across jurisdictions.

- Operational Resilience: Rethinking supply chains and delivery hubs.

- Trade War Uncertainty: Escalating tensions between major economies have introduced an added layer of unpredictability. Potential trade wars could lead to sudden tariff hikes, retaliatory regulations, and the unravelling of supply chain agreements. M&A activity in sectors like manufacturing, semiconductors, and pharmaceuticals could face significant due diligence challenges and longer deal cycles as a result.

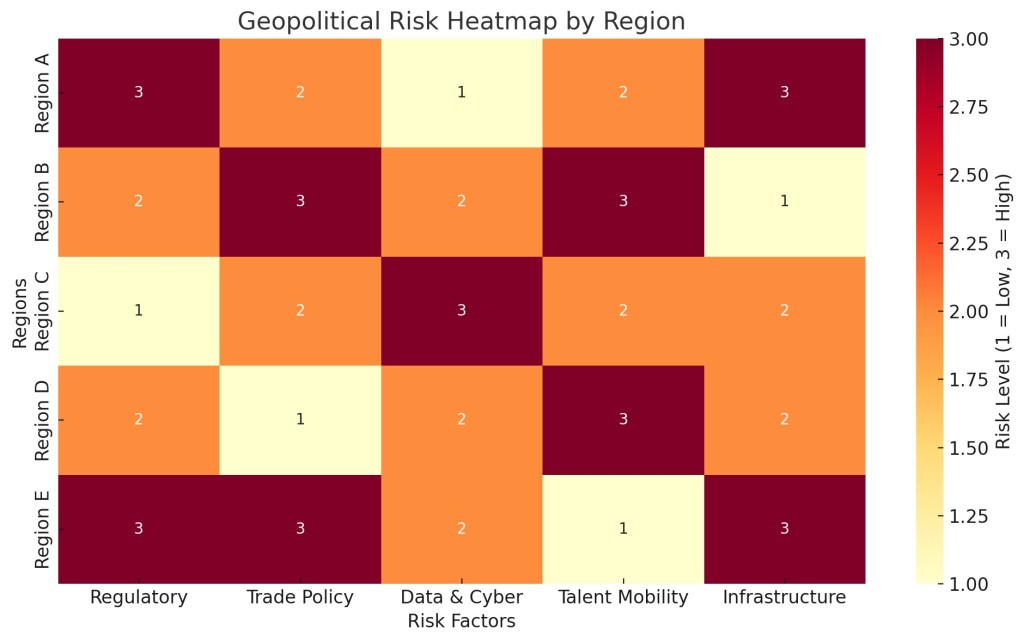

To help organizations assess geopolitical risks across integration targets and shared service locations, the following example framework can be used:

This example heatmap provides a visual tool to assess relative risk across five dimensions: regulatory, trade, data, talent, and infrastructure. Such clarity enables smarter decisions about location strategy, timing, and mitigation plans and can begin to inform a CRE strategy.

Agile Integration Models: From Big Bang to Modular Value Creation Core Elements of Agile M&A Integration:

Agility has emerged as the integration approach of choice for forward-thinking acquirers. Instead of one-size-fits-all roadmaps, agile models focus on delivering value early and iteratively through integration sprints.

- Integration Backlog: A prioritized list of tasks by value and urgency.

- Sprint-Based Execution: 2–4 week delivery cycles with cross-functional squads.

- Minimum Viable Integration (MVI): Avoids overengineering early in the process.

- Feedback Loops: Real-time data guides adjustments to priorities and pace.

This approach works especially well for technology deals, cross-border acquisitions, and organizations with complex operational footprints.

Shared Services and Location Strategy: Balancing Efficiency and Risk

Location is a critical factor in post-deal shared services strategy. It affects not only cost and efficiency, but also operational resilience and workforce stability.

Emerging Location Trends:

- Geo-Diversification: Moving from single-country hubs (e.g., only India or Poland) to dual or multi-region models that reduce risk and improve continuity.

- Nearshoring and Friendshoring: Shifting operations to countries with stable political alliances and regulatory alignment.

- Regulatory and Data Compliance: Selecting locations based on local data laws, labor regulations, and tax implications.

- Workforce Considerations: Factoring in language capability, digital skills, and employment stability.

These trends are reshaping the design of shared service centers and global business services (GBS) models. Companies must balance cost advantages with political and operational risks, using data-driven frameworks to reassess the optimal footprint for support functions like finance, HR, IT, and procurement.

Corporate Real Estate (CRE): Strategic Lever, Not Just Overhead

CRE plays a pivotal role in post-merger integration, especially when two entities bring together large and varied property portfolios. The shared services location strategy directly impacts the CRE footprint.

Considerations for CRE Integration:

- Portfolio Optimization: Rationalize the footprint, don’t just cut costs. Align with where shared services and centers of excellence will operate.

- Hybrid Work and ESG: Rethink space in light of new work models and sustainability goals.

- Impact of Location Strategy: A shift to nearshore or multi-region service delivery models may drive demand for new types of space (e.g., smaller collaborative hubs, regional satellites, or co-working centers).

- Minimum Viable Integration for CRE: Use temporary co-locations and shared services as pilots.

- Integrated Planning: Align CRE timelines with HR, IT, and finance integration.

A CRE agile playbook might include lease assessments, site prioritization sprints, workplace experience pilots, and a long-term capital investment roadmap.

Key Takeaways

- Geopolitics now drives operational M&A risks – assess early and plan for location agility.

- Agile models create value faster – focus on modular, iterative integration sprints.

- Location strategy is foundational – shared services delivery models must be resilient and aligned with geopolitical realities.

- CRE is a strategic asset – align physical footprint with future ways of working and service delivery locations.

- Cross-functional integration squads are essential – blend HR, IT, CRE, and Ops into agile delivery teams.

- Data-driven dashboards and feedback loops are critical to steer integration in real time.

As M&A becomes more operationally complex, companies that adopt an agile, geopolitically aware, and people-centered approach will be the ones who unlock long-term value. CRE, often the unsung hero, will play a starring role in shaping post-deal success.

Leave a comment