In managing large property portfolios, one of the key decisions facing senior leaders is determining whether to adopt a centralised or decentralised approach to structuring real estate teams. The right choice can significantly influence operational efficiency, agility, responsiveness, and cost-effectiveness.

In my experience of leading large-scale property portfolio transformations, I’ve worked with both centralised and decentralised models. A key insight is that driving a globally consistent model—especially if consistency is a strategic objective—is typically more successful through a centralised approach. However, local bases can also work effectively when appropriately supported.

Centralisation: The Power of Consistency and Scale

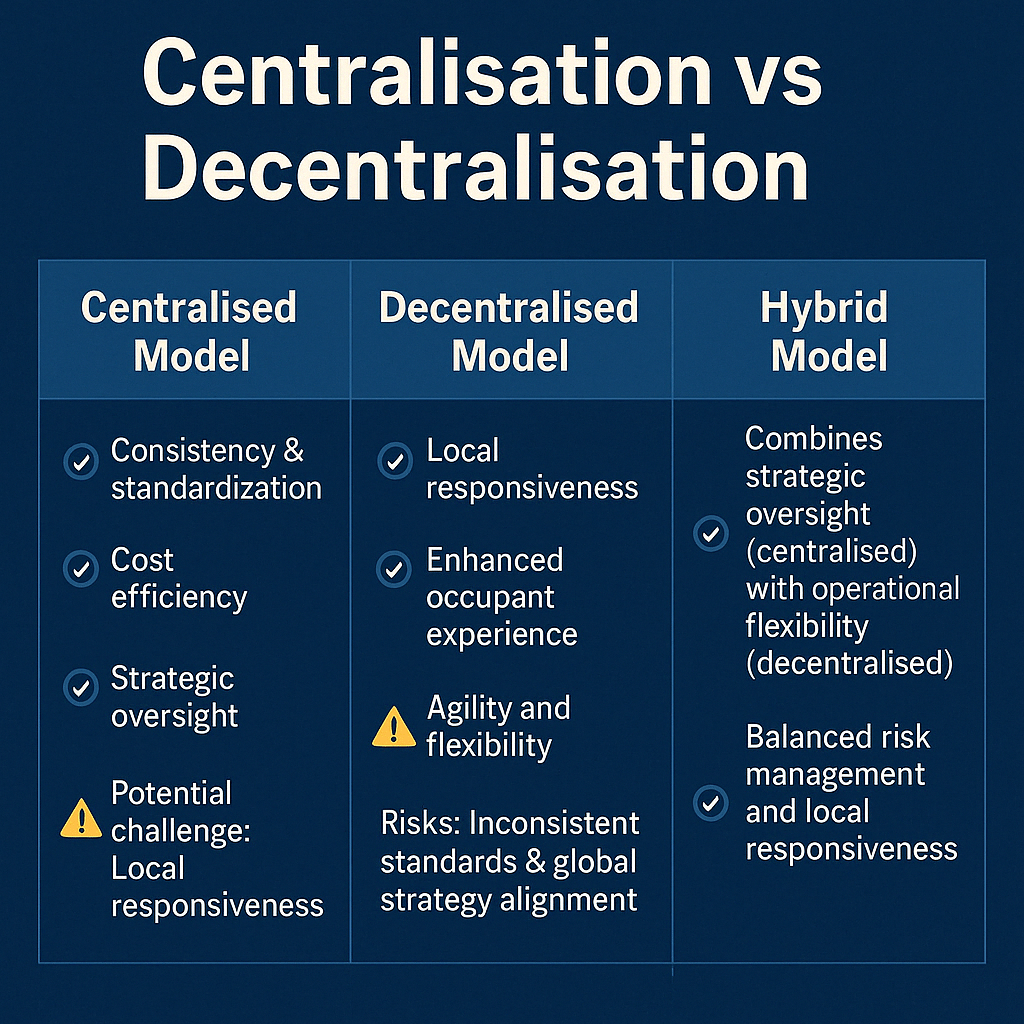

A centralised real estate team is typically headquartered in a single location (but it can operate with regional presence and centralised line management) , driving standardised processes and decisions across the entire portfolio. This structure enables:

- Cost efficiencies through economies of scale, consolidated procurement, and streamlined vendor management.

- Consistency in decision-making which simplifies governance, reporting, and compliance management.

- Enhanced strategic oversight, allowing leaders to quickly adjust portfolio strategies based on comprehensive, organisation-wide data.

While centralisation can initially appear to limit local responsiveness, this challenge can be effectively addressed through proactive strategies. Routine engagement with local leadership, regular surveys, focus groups, and an active change management program are powerful tools to maintain local responsiveness, ensuring that centralised teams remain closely attuned to local needs and issues.

Decentralisation: Maximising Local Responsiveness and Flexibility (with Associated Risks)

In contrast, decentralised real estate structures delegate decision-making and operational responsibilities to teams located closer to individual properties or markets. This model offers:

- Improved local market responsiveness, enabling rapid adaptation to specific regional conditions or opportunities.

- Enhanced occupant experience, thanks to local teams being attuned to unique tenant or employee needs.

- Greater agility and flexibility, allowing regional or local teams to innovate and adapt quickly without waiting for central approval.

However, decentralisation introduces significant risks related to maintaining consistency and alignment. Local teams may diverge from globally agreed standards, creating inefficiencies, inconsistent service levels, and operational complexities. Additionally, strong local influence can derail a cohesive global strategy, making it difficult to achieve enterprise-wide objectives and causing friction between regional priorities and global imperatives.

Hybrid Model: Balancing Central Control with Local Autonomy

Recognising that both centralisation and decentralisation offer distinct advantages, many organisations opt for a hybrid approach. A hybrid structure aims to:

- Centralise strategic functions like portfolio strategy, capital investment planning, and global vendor management.

- Decentralise tactical responsibilities such as daily property operations, facility management, and local tenant engagement.

This balanced approach seeks to harness the best of both worlds—leveraging the efficiencies and consistency of centralisation with the flexibility and responsiveness of decentralisation.

Choosing the Right Structure: Key Considerations

When assessing the optimal real estate team structure, consider:

- Scale of the Portfolio: Larger, globally dispersed portfolios often benefit from hybrid or decentralised models.

- Geographical Spread: Portfolios spanning diverse regions typically require more localised structures.

- Organisational Strategy and Culture: Aligning the team structure with the broader business strategy and cultural preferences ensures successful implementation and buy-in.

- Technology and Systems: Investing in robust technology platforms can mitigate many of the disadvantages associated with both centralisation and decentralisation, providing effective oversight while supporting local flexibility.

Ultimately, there is no one-size-fits-all approach. Careful evaluation of organisational goals, operational needs, and portfolio characteristics is essential to choosing the right real estate team structure that maximises portfolio performance and supports long-term organisational success.

Leave a comment